Publications

Evidence on Aggressive Tax Avoidance by German State-Owned Enterprises and its Driving Factors

(Joint work with Leon Ninow and Manuel Wagner), German Politics, 30(4), 541-561, 2021.

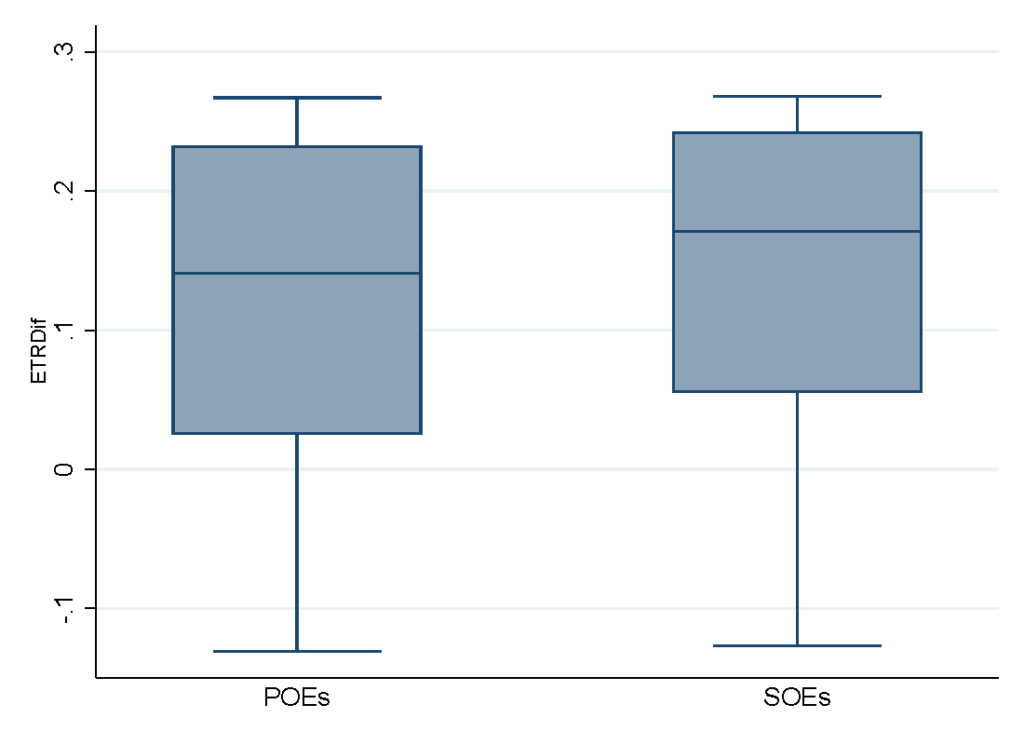

This paper investigates the tax avoidance behaviour of German state-owned enterprises (SOEs). Based on firm-specific data of state-owned and private firms from the period between 2004 and 2013 obtained from the Orbis database and public share reports (Beteiligungsberichte), it employs propensity score matching to analyse whether SOEs differ from private firms in their use of aggressive tax planning. Furthermore, a range of theories stemming from the Political Science and Economics literature that could explain SOEs’ tax planning behaviour are tested using fixed and random effects regressions. Results suggest that German SOEs engage in aggressive tax avoidance. This tax avoidance is positively affected by the total public share, the number of public shareholders and the relative power of the biggest private shareholder within the SOE. Market competition as well as the governing party coalition of the public owner cannot explain SOEs’ aggressive tax planning behaviour.

Corporate Income Taxes Around the World: A Survey on Forward-looking Tax Measures and Two Applications

(Joint work with Elias Steinmüller and Georg Wamser), International Tax and Public Finance. 26, 418-456, April 2019. Also available as CESifo Working Paper No. 7050, May 2018.

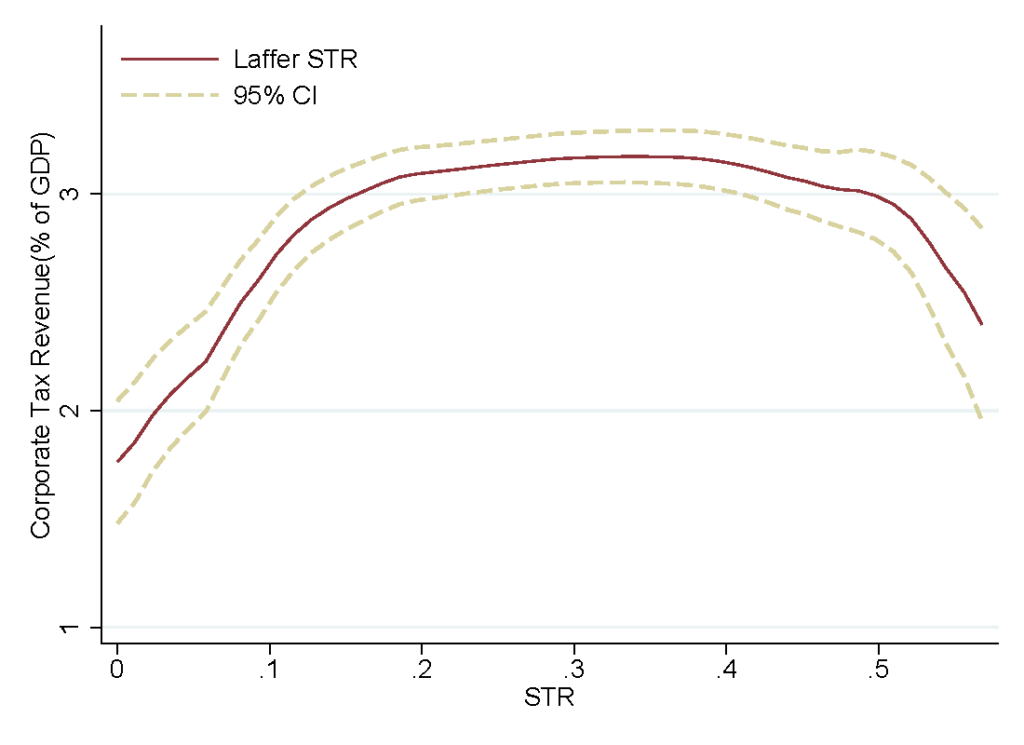

This study provides a survey on corporate taxes around the world. Our analysis has three main objectives. First, we collect tax data and calculate (forward-looking) effective tax measures for a large sample of countries and recent years. We particularly describe how these measures vary over time and across countries. Second, we augment the country-level information with firm- and industry-level data (providing weights for financial structure and asset composition) to contrast statutory measures at the level of countries with measures accounting for firm- and industry-specific weights. Third, we utilize our new data to (i) estimate Laffer-Curves, i.e., the relationship between statutory tax rate and tax revenue, based on nonparametric as well as parametric specifications; (ii) examine how taxes affect investment in fixed assets at the level of firms. As for the latter, our preferred specification, in which we use a firm-specific effective marginal tax rate to capture tax incentives, suggests an elasticity of −0.33.

The ITI Database: New Data on International Tax Institutions

(Joint with Georg Wamser, Valeria Merlo, Frank Stähler, Kristina Strohmaier, Jonathan Eklund, Tobias Hahn, Jaqueline Hansen, Nora Hiller, Sabine Laudage, and Sean Mc Auliffe), International Tax and Public Finance, forthcoming.

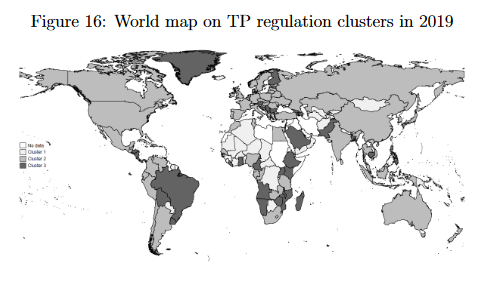

This article introduces the new International Tax Institutions (ITI) database, a unique attempt to collect the most relevant statutory tax indicators for the whole world. It includes taxes on corporate and personal (earned and capital) income, consumption taxes, as well as anti-

tax avoidance rules (thin-capitalization and earnings-stripping rules, CFC rules and transfer pricing regulations). Our main objective is to provide a broad overview on key features, (time- and cross-sectional) variation, and regularities in the data, with a focus on international tax issues. We present a vast number of new variables – such as effective tax and institutional measures – that allow for a comprehensive description and comparison of countries’ taxes and tax systems.

Working Papers

Identifying tax-setting responses from local fiscal policy programs

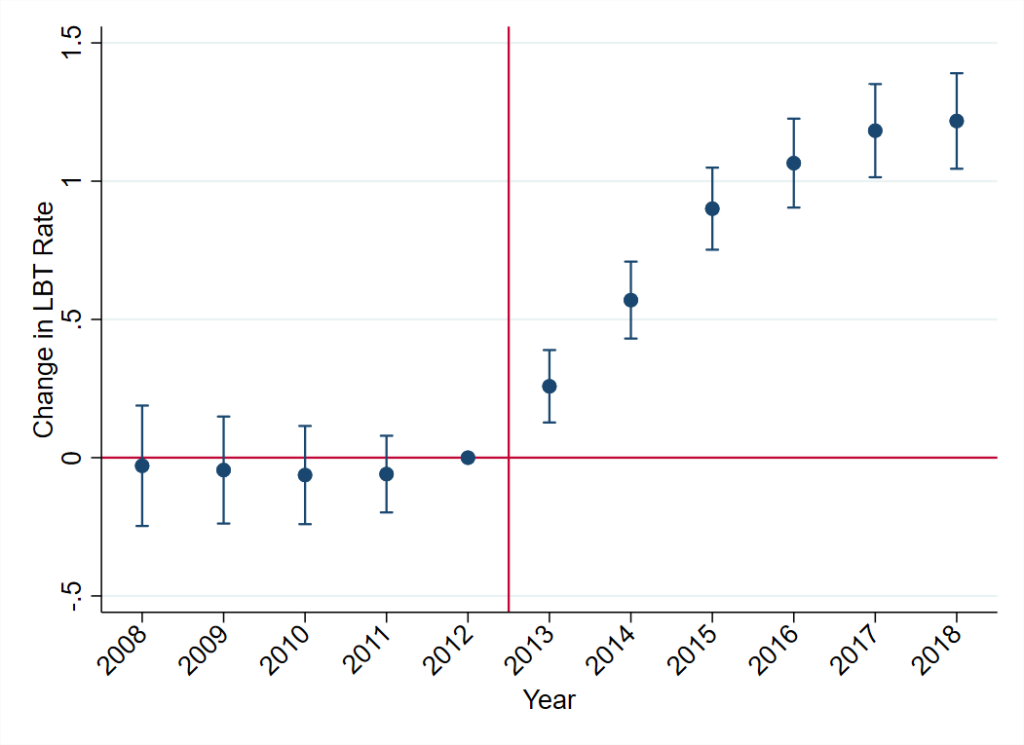

(Joint work with Valeria Merlo, Andreas Schanbacher and Georg Wamser), available as CESifo Working Paper No. 10473, May 2023.

This paper studies tax-policy interaction and competition among local governments for both mobile and immobile tax bases. We exploit exogenous changes in the local tax setting of German municipalities due to participation in state debt reduction programs to learn about the size, scope and nature of strategic interaction among local governments. Our results suggest strong and significant tax-policy responses both in corporate and property tax rates. Based on these results, we calculate tax-response function gradients in a range of 0.30 to 0.69. Spatial, political, demographic, and administrative municipality characteristics all influence the tax response qualitatively and quantitatively.

Are consumers paying the bill? How international tax competition affects consumption taxation

available as RSIT Working Paper No. 3 2022.

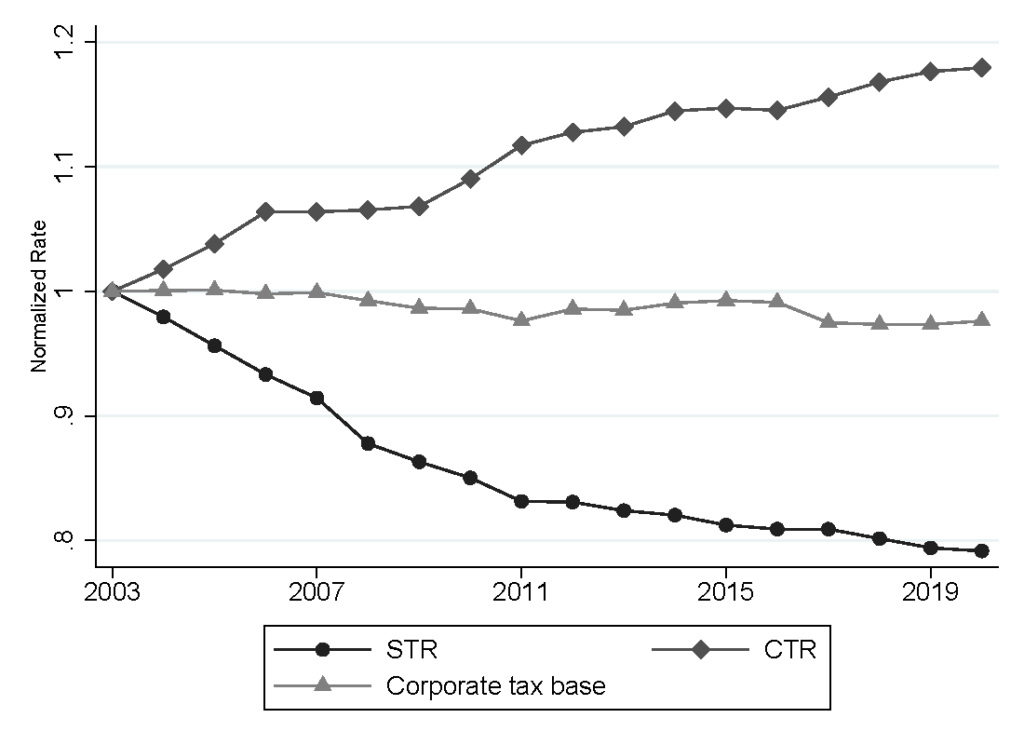

This paper empirically investigates the relationship between corporate and consumption tax rates and respective tax revenues to analyze whether governments are shifting the burden of corporate tax competition to consumption. First, I estimate the slope of the tax-policy reaction function between corporate and consumption tax rates by exploiting the cross-sectional interdependence (through tax competition) of corporate tax rates for an unbiased identification. Second, I analyze the revenue effects of both consumption and corporate tax rate changes. Third, I combine these results to evaluate the efficiency of governmental tax policy. I find that, on average, a one percentage point decrease in the corporate tax rate leads to a 0.35 percentage point increase in the consumption tax rate. The revenue effects of tax rate changes are estimated to follow an inverted U-shape in the case of corporate taxation, while consumption tax revenue only linearly depends on the tax rate. By substituting away from corporate taxes to consumption taxes, governments set corporate tax rates which seem to be close to the revenue-maximizing ones and, on average, fully compensate for revenue losses from corporate tax competition. All results are derived using a novel hand-collected data set of corporate and consumption tax regime information, covering more than 170 countries from 2003-2020.

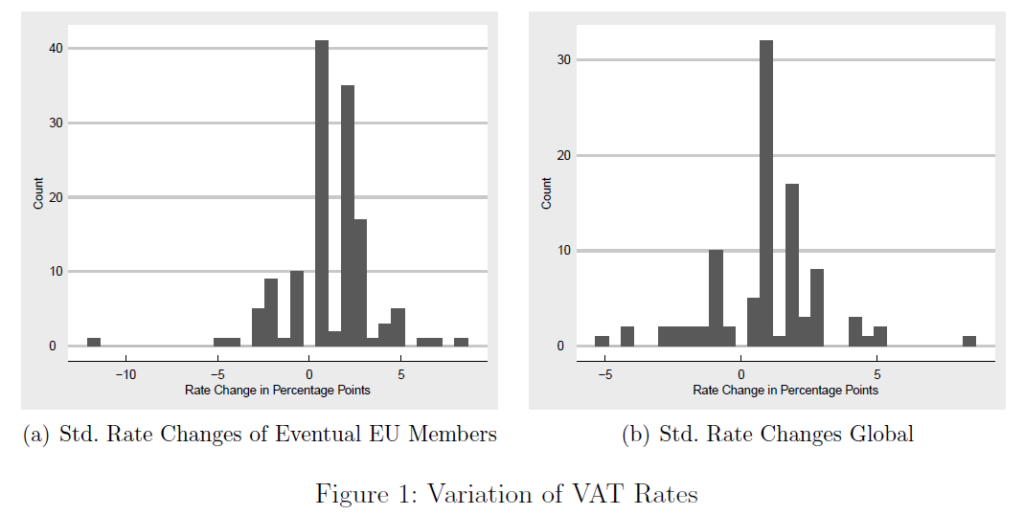

The (Non-)Neutrality of Value Added Taxation

(Joint work with Georg Schneider and Frank Stähler), available as CESifo Working Paper No. 9663, March 2022.

This paper employs a structural gravity model and novel value-added tax (VAT) regime data to investigate the impact of VAT rate changes on imports and domestic production of final goods. We demonstrate that the VAT is both non-neutral and discriminatory. A one percentage point VAT increase reduces aggregate imports and internal trade by 3.05% and implies a 5.4 to 7.9% reduction of foreign imports relative to internal trade. Based on these results we conduct a counterfactual equilibrium analysis and illustrate that VAT rate changes imply substantial welfare effects for an average country in the European Union.

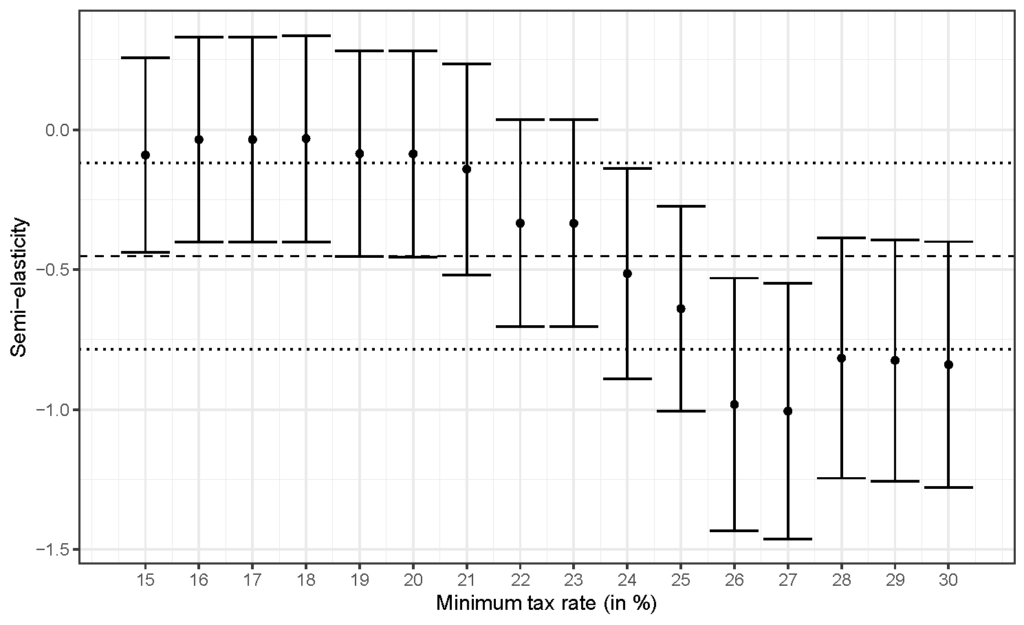

The Tax-Elasticity of Tangible Fixed Assets: Heterogeneous Effects of Homogeneous Tax Policy Changes

(Joint work with Sean Mc Auliffe and Georg Wamser), available as CESifo Working Paper No. 10628, August 2023.

This paper investigates the (heterogeneous) investment responses to corporate tax policy changes using novel country-industry-year-specific forward-looking effective tax rates (FLETRs) based on a panel of 11 industries, 70 countries, and the years 2001 to 2018. Besides statutory corporate tax rate and tax base determinants, the FLETRs account for typical country-industry-specific financing structures as well as asset compositions. We show that standard FLETRs suffer from significant measurement error when the latter information is neglected, owing primarily to inappropriately assigned asset weights to statutory depreciation allowances. Our empirical analysis exploits the substantial variation in FLETRs over time to provide estimates of the tax semi-elasticity of corporate investment in tangible fixed assets. Based on more than 24 million firm-entity observations, our results suggest a statistically significant tax semi-elasticity of -0.41, which is at the lower end of previous findings. In a second step we identify substantial heterogeneity in investment responses for different subgroups of firms that differ strongly from our average baseline response.

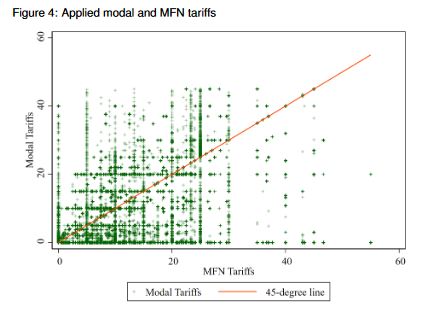

Falling tariffs: Implications of globalization-induced tariff reductions on firms, workers, and tax revenue implications

(Joint work with Nora Strecker and Benedikt Zoller-Rydzek), available as UNU-WIDER Working Paper.

Rising globalization has exerted a downward pressure on global tariffs, thereby eroding tariff revenues in developing nations. We analyze how gains from lowering import tariffs are distributed within the firm and the corresponding tax (base) implications. First, we study the effect of tariff changes on imports. Second, we estimate the firm-level semi-elasticities of profits, sales, capital, and wages with respect to import tariffs. Using linked employer-employee data and firm-product-level import data for South Africa we find that lowering tariffs, leads to higher imports and lower import prices, raises within firm wage inequality and favors capital owners, while overall government revenues decline. The latter is attributable to the insufficient expansion of alternative tax bases (profits, sales, and wages) after a tariff cut. This limits the government’s capacity to mitigate the adverse distributive effects arising from tariff reductions.

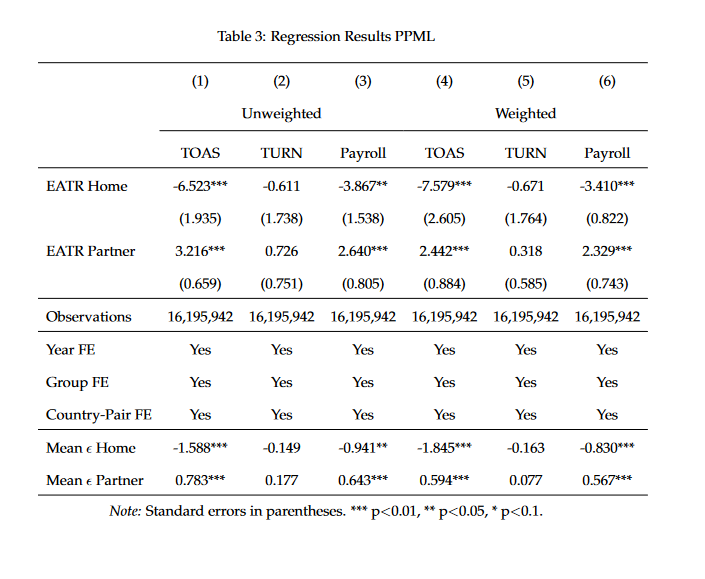

Fair and Efficient Division of Profit Tax Revenues

(Joint work with Kristoffer Berg) – Working Paper coming soon.

Profits are often created from activities across multiple jurisdictions. What is the optimal division of tax revenues across these jurisdictions? This paper addresses this question theoretically and empirically. First, we propose a new welfare function for fair division of profit tax revenues across jurisdictions, where jurisdictions’ claims to revenue depend on how much of multinational corporations’ capital, labour and sales are located within the jurisdiction. Second, we show how this theory can be applied to the optimal division of revenues when taxation distorts location decisions of corporate activities. Third, to speak to the extent of location responses, we exploit data on multinational corporations in the EU to estimate the current distribution of activities and the responsiveness of each activity to tax rate differentials. Fourth, using these results, we simulate optimal divisions of revenues for the EU under formula apportionment.

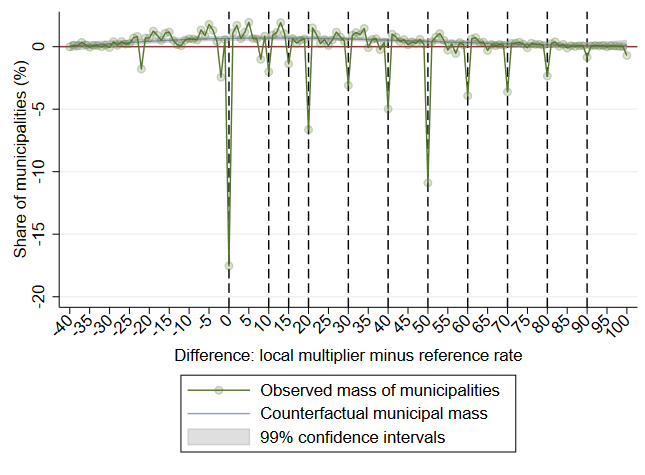

Pure Reference Points: Evidence from Germany.

(Joint work with Gabriel Loumeau) – Working Paper coming soon.

This paper studies the effect of `pure’ reference points, i.e., points that do not entail financial incentives, on policy choices. We exploit variation in the salience of reference rates in the German fiscal equalization systems to show that pure reference points can have a significant and large causal effect on policy choices.

Work in Progress

International Tax Competition: A Network Approach

(Joint with Corinna Coupette and Sebastian Dalleiger)

Bailouts, Fiscal Austerity, and Consolidation Strategies – Working Paper coming soon

(Joint with Zohal Hessami and Maximilian Thomas)

When two quarrel, the third rejoices: The third-party impact of EU-Russia trade sanctions in South Africa

(Joint with Lisa Scheckenhofer and Nora Strecker)

The Tax Elasticity of Housing Supply

(Joint with Stefanos Lagios)