Publications

Evidence on Aggressive Tax Avoidance by German State-Owned Enterprises and its Driving Factors

(Joint work with Leon Ninow and Manuel Wagner), German Politics, 30(4), 541-561, 2021.

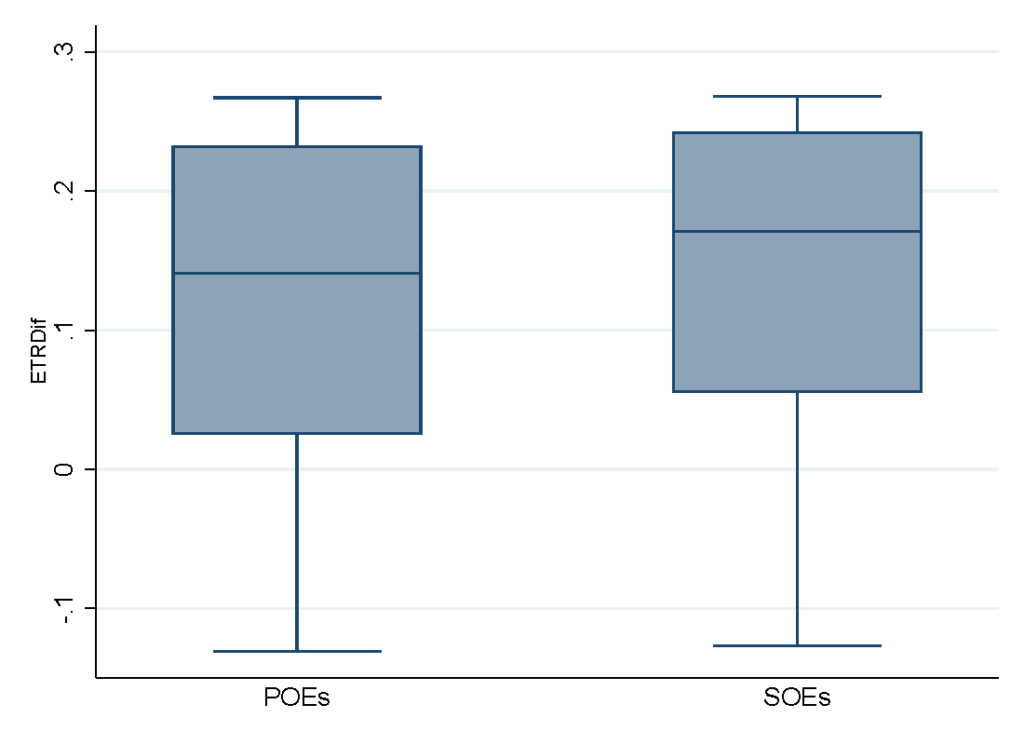

This paper investigates the tax avoidance behaviour of German state-owned enterprises (SOEs). Based on firm-specific data of state-owned and private firms from the period between 2004 and 2013 obtained from the Orbis database and public share reports (Beteiligungsberichte), it employs propensity score matching to analyse whether SOEs differ from private firms in their use of aggressive tax planning. Furthermore, a range of theories stemming from the Political Science and Economics literature that could explain SOEs’ tax planning behaviour are tested using fixed and random effects regressions. Results suggest that German SOEs engage in aggressive tax avoidance. This tax avoidance is positively affected by the total public share, the number of public shareholders and the relative power of the biggest private shareholder within the SOE. Market competition as well as the governing party coalition of the public owner cannot explain SOEs’ aggressive tax planning behaviour.

Corporate Income Taxes Around the World: A Survey on Forward-looking Tax Measures and Two Applications

(Joint work with Elias Steinmüller and Georg Wamser), International Tax and Public Finance. 26, 418-456, April 2019. Also available as CESifo Working Paper No. 7050, May 2018.

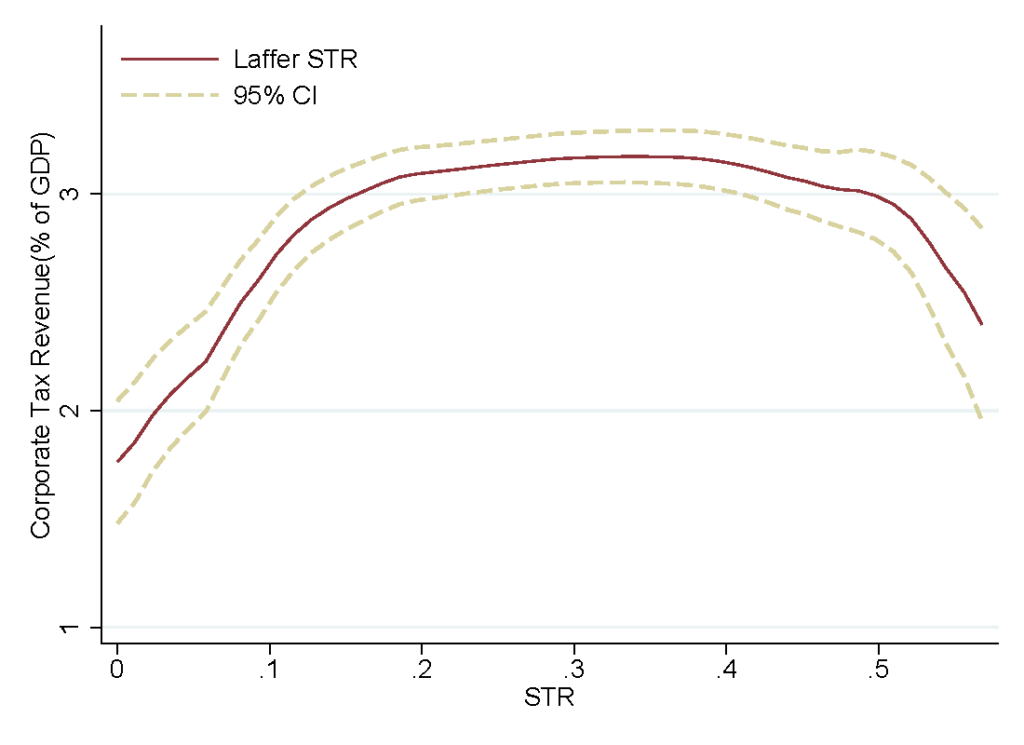

This study provides a survey on corporate taxes around the world. Our analysis has three main objectives. First, we collect tax data and calculate (forward-looking) effective tax measures for a large sample of countries and recent years. We particularly describe how these measures vary over time and across countries. Second, we augment the country-level information with firm- and industry-level data (providing weights for financial structure and asset composition) to contrast statutory measures at the level of countries with measures accounting for firm- and industry-specific weights. Third, we utilize our new data to (i) estimate Laffer-Curves, i.e., the relationship between statutory tax rate and tax revenue, based on nonparametric as well as parametric specifications; (ii) examine how taxes affect investment in fixed assets at the level of firms. As for the latter, our preferred specification, in which we use a firm-specific effective marginal tax rate to capture tax incentives, suggests an elasticity of −0.33.

Working Papers

Are consumers paying the bill? How international tax competition affects consumption taxation

available as RSIT Working Paper No. 3 2022.

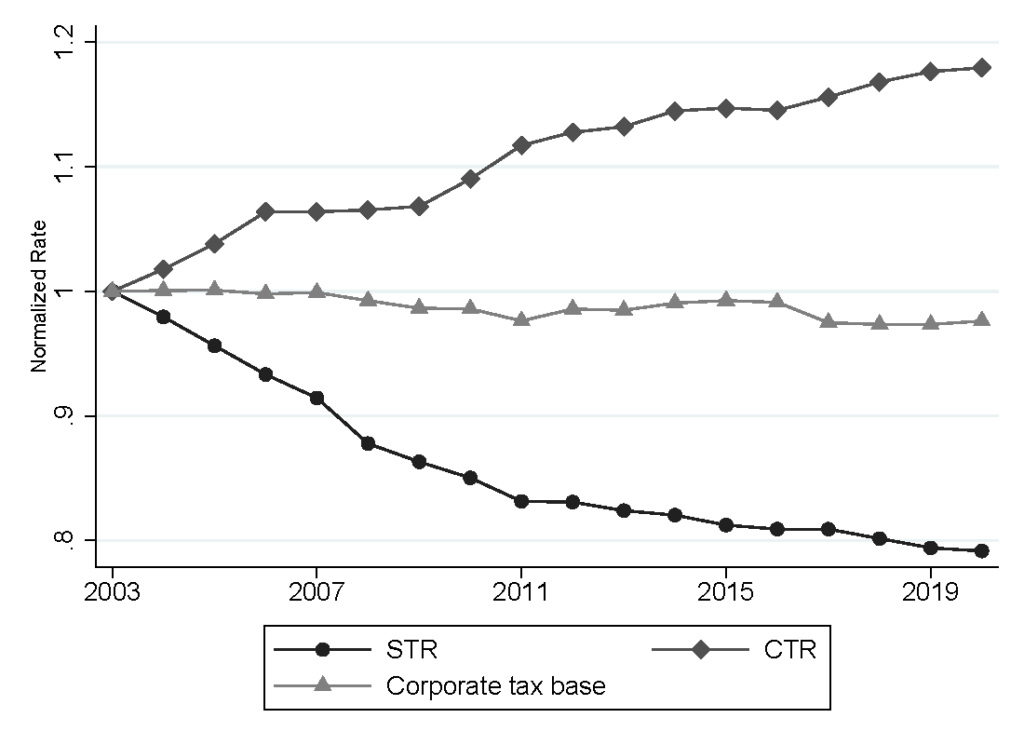

This paper empirically investigates the relationship between corporate and consumption tax rates and respective tax revenues to analyze whether governments are shifting the burden of corporate tax competition to consumption. First, I estimate the slope of the tax-policy reaction function between corporate and consumption tax rates by exploiting the cross-sectional interdependence (through tax competition) of corporate tax rates for an unbiased identification. Second, I analyze the revenue effects of both consumption and corporate tax rate changes. Third, I combine these results to evaluate the efficiency of governmental tax policy. I find that, on average, a one percentage point decrease in the corporate tax rate leads to a 0.35 percentage point increase in the consumption tax rate. The revenue effects of tax rate changes are estimated to follow an inverted U-shape in the case of corporate taxation, while consumption tax revenue only linearly depends on the tax rate. By substituting away from corporate taxes to consumption taxes, governments set corporate tax rates which seem to be close to the revenue-maximizing ones and, on average, fully compensate for revenue losses from corporate tax competition. All results are derived using a novel hand-collected data set of corporate and consumption tax regime information, covering more than 170 countries from 2003-2020.

The (Non-)Neutrality of Value Added Taxation

(Joint work with Georg Schneider and Frank Stähler), available as CESifo Working Paper No. 9663, March 2022.

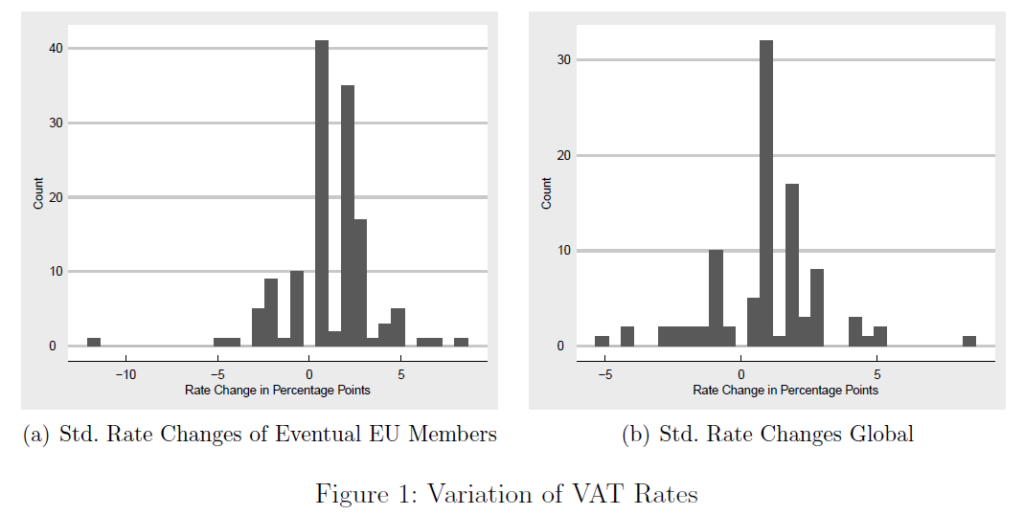

This paper employs a structural gravity model and novel value-added tax (VAT) regime data to investigate the impact of VAT rate changes on imports and domestic production of final goods. We demonstrate that the VAT is both non-neutral and discriminatory. A one percentage point VAT increase reduces aggregate imports and internal trade by 3.05% and implies a 5.4 to 7.9% reduction of foreign imports relative to internal trade. Based on these results we conduct a counterfactual equilibrium analysis and illustrate that VAT rate changes imply substantial welfare effects for an average country in the European Union.

The tax-elasticity of tangible fixed assets: Evidence from novel corporate tax data

(Joint work with Sean Mc Auliffe and Georg Wamser), available as CESifo Working Paper No. 10628, August 2023.

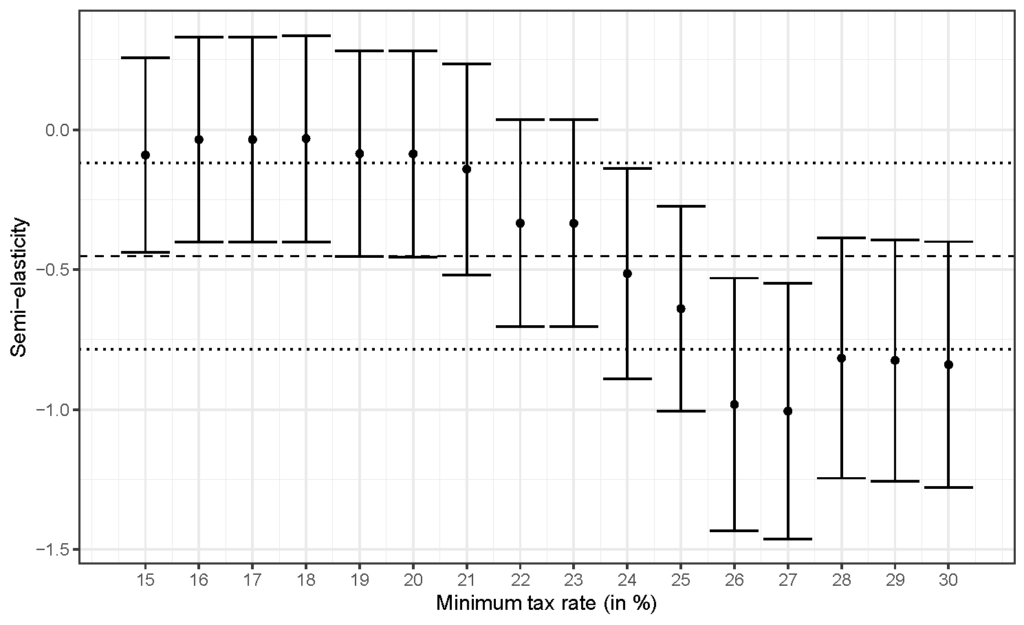

This paper develops a new approach to calculate country-industry-year-specific forward-looking effective tax rates (FLETRs) based on a panel of 19 industries, 221 countries, and the years 2001 to 2020. Besides statutory tax rate and tax base determinants, the FLETRs account for typical country-industry-specific financing structures as well as asset compositions. We show that FLETRs suffer from significant measurement error when the latter information is neglected, owing primarily to inappropriately assigned asset weights to statutory depreciation allowances. Our empirical analysis exploits the substantial variation in FLETRs over time to provide estimates of the tax semi-elasticity of corporate investment in tangible fixed assets. Based on more than 24 million firm-entity observations, our results suggest a statistically significant tax semi-elasticity of -0.41, which is at the lower end of previous findings. We further show that different subgroups of firms respond very heterogeneously to tax incentives.

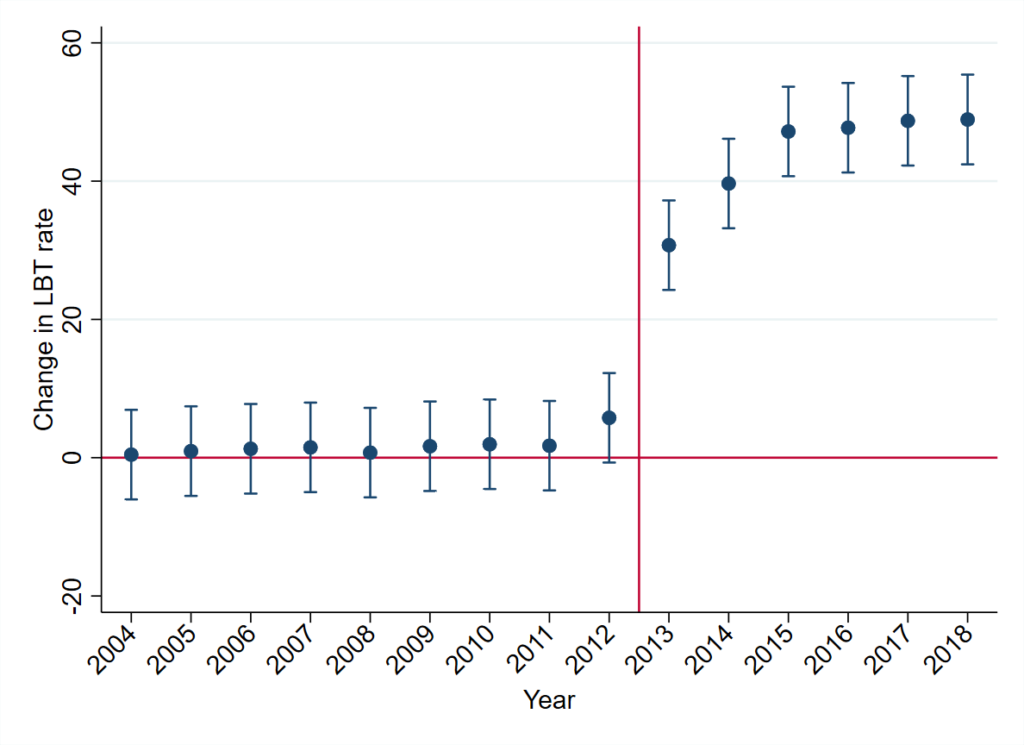

Identifying tax-setting responses from local fiscal policy programs

(Joint work with Valeria Merlo, Andreas Schanbacher and Georg Wamser), available as CESifo Working Paper No. 10473, May 2023.

This paper studies tax policy interaction among local governments for both mobile and immobile tax bases. We exploit exogenous changes in the local tax setting of German municipalities due to participation in state debt reduction programs to learn about the size, scope and nature of strategic interaction among local governments. Our results suggest strong and significant tax policy responses both in corporate as well asin property tax rates. Our estimates imply response function gradients in the range of 0.3 to 0.7, depending on the type of tax and state. Policy spillovers from property tax rates remain very local, which is consistent with yardstick competition behavior.

Work in Progress

Falling tariffs: Implications of globalization-induced tariff reductions on tax composition, complexity, compliance, and inequality

(Joint work with Nora Strecker and Benedikt Zoller-Rydzek)

The Complexity Trap: Evidence from Germany

(Joint with Gabriel Loumeau)

A new database on international tax institutions

(Joint with Georg Wamser, Valeria Merlo, Martin Ruf, Frank Stähler, Kristina Strohmaier, Jonathan Eklund, Jaqueline Hansen, Sabine Laudage, Sean Mc Auliffe, Johanna Paraknewitz,)